GIFT City 2025

విషయ సూచిక

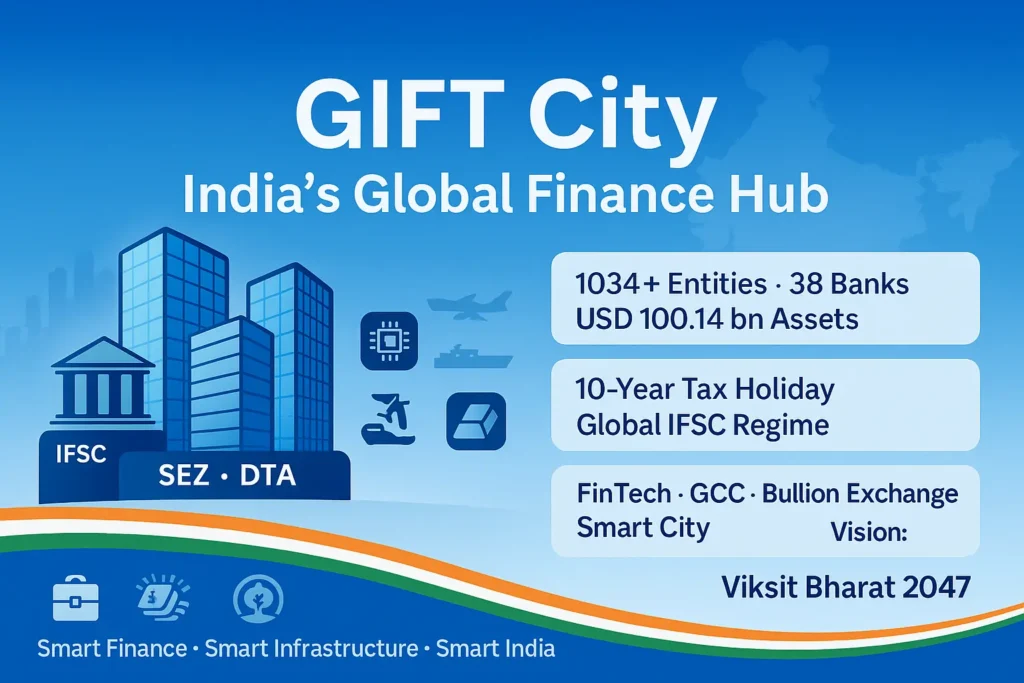

GIFT City (Gujarat International Finance Tec-City) is India’s first International Financial Services Centre (IFSC) and first operational smart city, located in Gandhinagar, Gujarat. It is designed as a global hub for finance, IT and FinTech, competing with international centres like Singapore and Dubai, and supporting the vision of Viksit Bharat 2047.

Key quick facts:

- India’s first operational IFSC and smart city

- Nearly 1000 acres, expanding to 3,300+ acres (DTA + GIFT SEZ)

- 1034+ registered entities in GIFT IFSC

- 38 banks with assets of USD 100.14 billion

- Offers 10-year income tax holiday in a 15-year block for IFSC units

1. Vision and Objectives of GIFT City

- Act as a gateway for global capital into India

- Provide onshore–offshore financial services from Indian soil

- Create a high-quality employment ecosystem in finance, IT, and FinTech

1.1Major Goals

- Position India as a leading global financial centre by 2047

- Attract sovereign wealth funds, pension funds, hedge funds, PE funds

- Support regulatory innovation (sandboxes, new products)

- Drive FinTech-led development with a unified sandbox

2. Governance Structure – IFSCA and IFSC

2.1 Regulatory Framework

| కోణం | డీటైల్స్ |

|---|---|

| చట్టపరమైన ఆధారం | IFSC under SEZ Act, 2005 |

| Main Regulator | International Financial Services Centres Authority (IFSCA) |

| IFSCA Act | 2019 (Authority operational since April 2020) |

| Powers | Consolidates earlier IFSC powers of RBI, SEBI, IRDAI, PFRDA |

| విధి | Regulates & develops financial products, services, institutions in GIFT IFSC |

The IFSC units in GIFT City are treated as non-residents under FEMA, allowing them to deal primarily in foreign currency.

3. Business Ecosystem in GIFT City

3.1 Entity Presence and Rankings

| సూచిక | Data (2025) |

|---|---|

| Total registered entities in GIFT IFSC | 1034+ |

| Global Financial Centres Index rank | 46th (highest ever) |

| Rank among 15 emerging centres | 5th (and top in reputation index) |

| Banks in GIFT IFSC | 38 |

| Banking asset base | USD 100.14 billion |

| Cumulative banking transactions | USD 142.98 billion |

3.2 Sector-wise Highlights

| Segment | Key Numbers / Points |

|---|---|

| Finance & Treasury | 4 Global/Regional Corporate Treasury Centres; 18+ core finance companies |

| Capital Markets | 2 international stock exchanges; avg monthly turnover USD 89.67 bn; fund-raising commitments USD 26.30 bn; 194 Fund Management Entities; GIFT Nifty monthly turnover USD 102.35 bn (May 2025) |

| Insurance | 52 insurers & intermediaries; USD 425 mn gross premiums |

| Leasing | 37 aircraft lessors (303 aviation assets); 34 ship lessors (28 ships) |

| FinTech/TechFin | 20 registered entities; 8 sandbox entities |

| Ancillary Service Providers | 88+ |

4. Key Institutions – From Bullion to GCCs

4.1 India International Bullion Exchange (IIBX)

- Launched July 2022 at GIFT IFSC

- Promoted by NSE, INDIA INX, NSDL, CDSL, MCX

- Regulated by IFSCA

- Acts as a gateway for bullion imports, offers trading platform & vaulting

- Follows OECD due-diligence guidelines for responsible bullion trade

4.2 Global In-House / Capability Centres

A Global In-House Centre (GIC) / Global Capability Centre (GCC) in GIFT IFSC:

- Exclusively serves financial services groups (banks, NBFCs, intermediaries, IBs)

- Operates in foreign currency from an IFSC unit

- Governed by IFSCA (Global In-House Centres) Regulations, 2020

Major GCC players in or around GIFT City:

- Infineon Technologies, Technip Energies, TELUS, Tata Electronics

- Accenture, Capgemini, IBM Consulting

- NASSCOM Centre of Excellence (deep-tech innovation)

5. FinTech Ecosystem

5.1 Regulatory Setup

- FinTech framework via IFSCA circular (27 April 2022)

- Dual routes for entities:

- Direct authorisation

- FinTech Sandbox for experimentation

- As of 2025: 20 FinTech/TechFin firms and 8 sandbox firms live

5.2 International Fintech Innovation & Research Centre

Joint initiative of Government of Gujarat + Asian Development Bank:

- Partners: IIT Gandhinagar, Ahmedabad University, UC San Diego, Plug and Play

- Focus: training, incubation, acceleration, research, and cross-border collaboration

This makes GIFT City a core node in India’s FinTech and digital-finance story.

6. Setting Up Business in GIFT City – Eligibility Snapshot

| పరామితి | Condition |

|---|---|

| Who can set up? | Entities of financial services groups from FATF-compliant jurisdictions |

| Activities | Support/undertake financial services linked to financial products |

| Legal forms | Company, LLP, Branch, or other permitted form |

| FEMA treatment | IFSC unit treated as non-resident |

| Regime | Light-touch regulation + single-window clearance |

7. Fiscal & Regulatory Incentives in GIFT City

7.1 Direct & Indirect Tax

- 10-year income tax holiday within a 15-year block (Sec. 80-LA, IT Act)

- Reduced withholding tax on interest income

- No GST on transactions within IFSC

- Customs duty exemption on goods imported into SEZ

7.2 Other Incentives

- Exemptions under Companies Act, 2013

- No Securities Transaction Tax (STT) or Commodity Transaction Tax (CTT)

- Stamp duty exemption on certain transactions

- 100% reimbursement of employer’s PF contribution (as per policy)

- State-level IT/ITeS incentives for CAPEX/OPEX, employment, electricity duty, etc.

GIFT City also benefits from:

- Delegation of SEZ Development Commissioner powers to IFSCA

- ingle Window IT System (SWITS) for IFSC units

8. World-Class Infrastructure – Smart City Features

8.1 Civic Infrastructure

| System | ముఖ్య లక్షణాలు |

|---|---|

| District Cooling System | Centralised cooling; ~30% less energy than conventional AC |

| Automated Waste Collection (AWCS) | Pneumatic waste network; low transport emissions |

| Underground Utility Tunnel | 17-km tunnel carrying power, water, sewage, telecom – “no-dig city” |

| Zero-Discharge Water | 24×7 potable water; sewage reuse; Samrudhi Sarovar for 15-day storage |

| Power Reliability | 99.999% reliable; only 5.3 minutes outage per year |

| Digital Backbone | Optical fibre ring; 15+ telecom operators |

| Tier-IV Data Centre | STT Global facility with LEED Gold, ISO/PCI-DSS standards |

9. Smart Governance – City Command & Control Centre (C4)

The C4 centre is the digital brain of GIFT City:

- Monitors power, cooling, water, waste, lighting, GIS in real time

- 70,000+ input/output points for data and control

- SCADA-based monitoring for 24×7 utilities

- Single dashboard for incident management and urban operations

GIFT Urban Development Authority and the Notified Area Committee ensure single-window urban governance.

👉 డైలీ కరెంట్ అఫైర్స్ విభాగానికి వెళ్లండి

10. Frequently Asked Questions

What is GIFT City and where is it located?

Gujarat International Finance Tec-City is India’s first International Financial Services Centre (IFSC) and first operational smart city. It is located between Gandhinagar and Ahmedabad in Gujarat.

Why was GIFT City created?

Gujarat International Finance Tec-City was created to build a global financial and IT hub within India, attract offshore financial business that earlier went to centres like Singapore or Dubai, channel global capital for India’s growth, and create high-skill employment.

Who regulates financial activities in GIFT City?

The International Financial Services Centres Authority (IFSCA) regulates all financial products, services, and institutions in GIFT IFSC. It acts as a unified regulator, replacing fragmented oversight of RBI, SEBI, IRDAI, and PFRDA within the IFSC.

What are the main tax benefits available in GIFT City?

Key tax benefits include a 10-year income tax holiday within 15 years, GST exemption on IFSC transactions, customs duty exemption for imports into the SEZ, and no STT/CTT and stamp duty exemptions on specific transactions.

How is GIFT City different from a normal SEZ?

While it has a multi-services SEZ (GIFT SEZ), GIFT City also houses India’s only operational IFSC, with a dedicated regulator (IFSCA), foreign-currency operations, special financial products (like aircraft/ship leasing, bullion exchange), and a smart-city scale infrastructure.

What is the role of FinTech in GIFT City’s growth?

FinTech is a core pillar in GIFT City. IFSCA offers sandboxes, direct authorisation routes, and innovation support. The city hosts 20+ FinTech/TechFin entities, an International Fintech Innovation & Research Centre, and is emerging as a global hub for digital financial services.

How does GIFT City support India’s Viksit Bharat 2047 vision?

By channelling international capital, creating high-end jobs, hosting foreign universities and cutting-edge FinTech, and positioning India as a leading global financial centre, GIFT City directly contributes to the long-term vision of a developed India by 2047.

Reference: GIFT City