Economic Reforms in India: A Powerful Story of Crisis, Courage & Change (1991–2024)

Table of Contents

Why Economic Reforms Matter for Aspirants

Economic reforms in India are not just about policies, budgets, or abbreviations like LPG. They represent one of the most dramatic transformations in independent India’s history. From a country that once struggled to pay for two weeks of imports, India today is:

- A $3.5 trillion economy

- A global IT and services hub

- One of the fastest-growing major economies

For APPSC, UPSC, SSC and Group exams, questions from economic reforms were repeatedly asked in Prelims, Mains and Interviews. This article gives you complete concepts, timeline, stories behind these reforms.

What Are Economic Reforms?

Economic reforms refer to systematic policy changes introduced by the government to:

- Improve economic efficiency

- Increase growth

- Reduce government control

- Encourage private sector participation

- Integrate with the global economy

Background: India Before Economic Reforms (Pre-1991)

Before 1991, India followed a socialist, state-controlled economic model.

Characteristics

- License Raj (permissions for everything)

- High import tariffs

- Dominance of Public Sector Units (PSUs)

- Minimal foreign investment

- Inefficient industries

Result

- Low growth (≈3.5% — “Hindu rate of growth”)

- Poor competitiveness

- Chronic shortages

- Rising fiscal and trade deficits

The 1991 Balance of Payments Crisis

The Real Crisis (A Story Every Aspirant Must Know)

In 1991:

- India’s foreign exchange reserves fell to $1 billion

- At this stage, Indian government had enough foreign reserves to cover only 2–3 weeks of imports

- International lenders refused fresh loans

India had to airlift 47 tonnes of gold to the Bank of England as collateral to get the loan. This was done quietly at night to avoid public panic. The 1991 economic reforms were not ideological; they were born out of compulsion. This is not only the problem. At that time, Private companies needed government permission for everything. Foreign companies were seen as threats.

1991 Economic Reforms: The New Economic Policy (LPG)

The reforms launched in July 1991 are collectively known as the New Economic Policy based on Liberalisation, Privatisation, and Globalisation (LPG).

1. Liberalisation: Ending Excessive Government Control

What Was Done

- Abolition of industrial licensing (except few sectors)

- Reduction in import tariffs

- Market-based exchange rate

- Deregulation of interest rates

Impact

- Faster industrial growth

- Increased competition

- Greater efficiency

“No power on Earth can stop an idea whose time has come.”

This line symbolised India’s historic shift towards economic freedom and reforms.

2. Privatisation: Redefining the Role of the State

Reducing government ownership and encouraging private sector participation.

Measures

- Disinvestment in PSUs

- Strategic sales

- Greater autonomy to public enterprises

The government realised that its role should be to regulate the economy, not run businesses. It also understood that the State must concentrate on its core responsibilities — health, education, and infrastructure — instead of managing loss-making enterprises.

3. Globalisation: Integrating with the World Economy

Steps Taken

- Encouraged Foreign Direct Investment (FDI)

- Trade liberalisation

- Technology and capital inflows

Result

- India became a global services hub

- Export growth accelerated

India became a founding member of the World Trade Organisation (WTO) on 1 January 1995, which integrated the Indian economy with global markets. After joining the WTO, Indian IT companies such as Infosys, TCS, and Wipro expanded globally, Indian engineers became internationally employable, and India emerged as the “back office of the world”, supplying software services, BPO, and IT support to global corporations.

Role of Leadership

P.V. Narasimha Rao

- Provided political cover

- Managed coalition pressures

- Implemented reforms quietly but decisively

Dr. Manmohan Singh

- Designed reforms technically

- Built global credibility

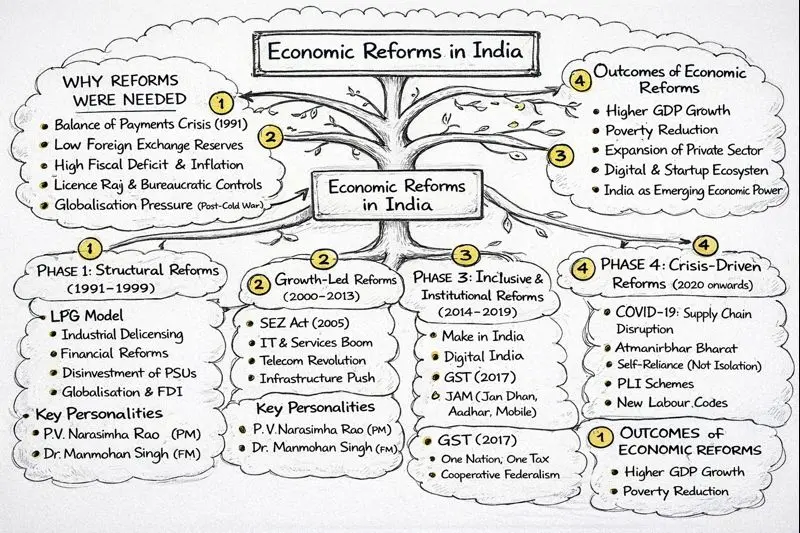

Economic Reforms After 1991: Phase-Wise Evolution

Phase 1: Post-1991 Consolidation (1995–2000)

Key Developments

- WTO membership (1995)

- Telecom reforms

- Banking sector reforms (Narasimhan Committees)

Telecom Story

Before economic reforms, getting a telephone connection in India was a long and frustrating process. People often waited for several years just to get a landline connection. Telephones were considered luxury items, affordable only to a small section of society, and making calls was extremely expensive. Communication was slow, limited, and out of reach for most households.

After economic reforms, especially in the 2000s, private companies were allowed to enter the telecom sector. Increased competition led to lower call charges and better services. Mobile phones became affordable and widespread, reaching even remote villages, transforming communication and connecting millions of people across the country.

Economist and former Governor of Reserve Bank of India Raghuram Rajan once said, “Telecom reforms delivered more welfare than many subsidy schemes.”

Phase 2: Reforms of the 2000s

The economic reforms of the 2000s focused on accelerating growth and integrating India more deeply with the global economy. The Special Economic Zones (SEZ) Act, 2005 encouraged export-oriented manufacturing and services by offering world-class infrastructure and tax incentives. At the same time, the IT and services sector expanded rapidly, making India a global hub for software, BPO, and knowledge services. The government also increased spending on roads, ports, power, and telecom infrastructure. These reforms led to faster urbanisation, large-scale employment generation, and the rise of a confident middle class with higher incomes and consumption power.

Phase 3: Inclusive & Structural Reforms (2014–2019)

Between 2014 and 2019, the focus shifted from only growth to inclusive and structural reforms. Initiatives like Make in India aimed to boost domestic manufacturing and job creation, while Digital India transformed service delivery and financial inclusion. The introduction of the Goods and Services Tax (GST) in 2017 was a landmark reform that unified the national market under the principle of “One Nation, One Tax.” After nearly 17 years of negotiations between the Centre and the States, GST emerged as a strong example of cooperative federalism. The Insolvency and Bankruptcy Code (IBC) further strengthened the economy by ensuring faster resolution of stressed assets and improving the business environment.

Former Finance Minister Arun Jaitley described GST as “India’s greatest example of cooperative federalism.”

Phase 4: Crisis-Driven Reforms (2020 onwards)

The COVID-19 pandemic exposed serious weaknesses in global supply chains and India’s dependence on imports for critical items such as PPE kits and pharmaceutical APIs. This crisis acted as a wake-up call for policymakers. In response, the government launched Atmanirbhar Bharat, focusing on building domestic capabilities while remaining globally connected. Production Linked Incentive (PLI) schemes were introduced to attract investment in key sectors, and new labour codes were enacted to simplify laws and improve industrial flexibility.

Importantly, Atmanirbhar Bharat does not mean isolation; it represents India’s vision of becoming a self-reliant yet globally competitive economy.

Father of Indian Economic Reforms

Dr. Manmohan Singh

- Architect of 1991 reforms

- Former Finance Minister & Prime Minister

Impact of Economic Reforms in India

Positive Outcomes

- Higher GDP growth

- Poverty reduction

- Rise of middle class

- Global integration

- Digital economy

Challenges

- Inequality

- Jobless growth

- Informal sector stress

- Regional imbalance

Economic reforms delivered growth, but distribution and employment remain policy challenges.

1) Industrial licensing was abolished for all industries in 1991.

2) Foreign Direct Investment was completely prohibited before 1991.

Which of the statements given above is/are correct?

Explanation: In 1991, industrial licensing was largely reduced, but not abolished for all industries—some strategic/sensitive sectors still had controls. Also, FDI was not completely prohibited before 1991; it existed but was highly restricted and tightly regulated.

Explanation: 1991 reforms included devaluation, delicensing, and trade liberalisation to open up the economy. Bank nationalisation happened earlier (not part of the 1991 reform package).

Explanation: India faced a severe foreign exchange shortage in 1991 (BOP crisis), pushing the government to undertake structural reforms and liberalisation measures.

Explanation: Dr. Manmohan Singh, as Finance Minister (1991), led the reform package (LPG) that transformed India’s economic policy direction.

Explanation: The immediate trigger was a sharp forex crisis (BOP crisis), which forced reforms like devaluation, external assistance, and liberalisation.

Explanation: Reforms aimed to reduce the government’s role in business, including disinvestment, deregulation, and opening to competition.

👉 Go to Daily Current Affairs Section

Frequently Asked Questions (FAQ)

1. What are economic reforms in India?

Economic reforms are policy changes introduced to liberalise, privatise, and globalise the Indian economy for higher growth and efficiency.

2. Why were economic reforms introduced in 1991?

Due to a severe Balance of Payments crisis when India had foreign reserves for only two weeks of imports.

3. Who is called the father of Indian economic reforms?

Dr. Manmohan Singh.

4. What is LPG model?

Liberalisation, Privatisation, and Globalisation — the core framework of 1991 reforms.

5. Are economic reforms still ongoing?

Yes. Reforms continue through GST, PLI, labour codes, digital economy, and green transition.

6. What are the three components of economic reforms?

Liberalisation, privatisation and globalisation are the three economic reforms, transformed the India’s economy.

For Aspirants

I hope you now understand why economic reforms were needed, how they gradually evolved over time, and the real human stories and decisions that shaped India’s reform journey.

Reference: PIB