Monetary Policy Committee

Table of Contents

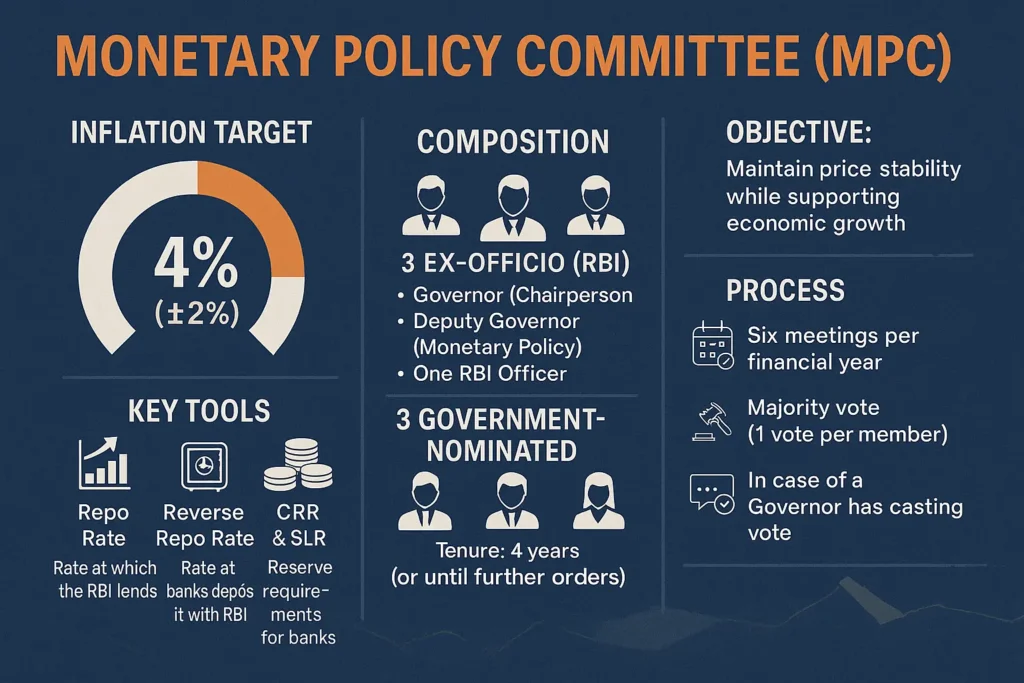

The Monetary Policy Committee (MPC) was established under the amended RBI Act in 2016 to decide interest rates and maintain price stability. This article explains its composition, objectives, tools, decision process, and notable challenges — tailored for competitive exam aspirants.

Why Monetary Policy Committee was formed?

- Before MPC, the RBI Governor alone used to make decisions on interest rates, advised by a Technical Advisory Committee (TAC).

- There were concerns about lack of transparency, accountability, and predictability in rate decisions.

- To institutionalize rate decisions, the Finance Act, 2016 amended the RBI Act, 1934 to include Section 45ZB, 45ZC, etc.

- MPC formally came into existence in September 2016.

- The framework introduced inflation targeting (flexible inflation targeting) with a clear target band (4% ± 2%) as mandated by the Central Government in consultation with RBI.

What is the Monetary Policy Committee?

The Monetary Policy Committee (MPC) is a six-member committee created under the RBI Act to make decisions on India’s benchmark interest rates (such as the repo rate) and manage inflation.

Objective

- Price stability is the primary goal (i.e. controlling inflation).

- But MPC must also support economic growth, so it has a dual mandate: balancing inflation and growth.

- The official inflation target is 4% CPI, with a tolerance band of ±2% (i.e. between 2% and 6%).

Composition & Tenure

| Type | Members | Details |

|---|---|---|

| Ex officio (RBI) | 3 | • Governor (Chair) • Deputy Governor in charge of monetary policy • One officer of RBI nominated by its Central Board |

| Government-nominated / External | 3 | Appointed by the central government, on the recommendation of a selection committee. |

| Tenure | 4 years or until further orders | Government-nominated members can’t be reappointed. |

- Each member has one vote. Decisions are taken by majority rule.

- If there is a tie, the Governor of RBI has the casting (tie-breaker) vote.

- There is a quorum requirement (minimum number of members present) for meetings — typically four members must be present, including at least one of the ex officio, like the Governor or Deputy Governor.

Meetings & Decision Process

- MPC meets six times a year (once every two months). Some sources say at least four times, but standard is bi-monthly.

- Before the meeting, the RBI staff and departments prepare background papers, macroeconomic projections, inflation forecasts, and scenario analyses.

- During meetings, members discuss current economic data (inflation trend, growth forecasts, global indices), and then vote on repo rate, reverse repo, stance of policy.

- After the meeting, RBI releases a Monetary Policy Statement / Resolution giving rationale, voting pattern, and projections.

Tools & Instruments Used by MPC

Though MPC directly decides on policy rates, it influences the economy via various tools. Key ones include:

| Instrument | Purpose / Use |

|---|---|

| Repo Rate | Rate at which RBI lends to banks — lowering it makes credit cheaper. |

| Reverse Repo Rate | Rate banks get when depositing surplus funds with RBI. |

| Cash Reserve Ratio (CRR) | Percentage of deposits banks must keep as reserves with RBI. |

| Statutory Liquidity Ratio (SLR) | Banks must maintain a certain proportion of liquid assets (government securities, gold). |

| Open Market Operations (OMOs) | Buying/selling government securities to inject or absorb liquidity. |

| Marginal Standing Facility (MSF) | Lending facility to banks on overnight basis above repo rate. |

| Liquidity Adjustment Facility (LAF) | Repo/Reverse repo operations to manage short-term liquidity. |

| Standing Deposit Facility / Standing Deposit Rate | Newer tool in liquidity management. |

These tools help MPC transmit its rate signals into the banking and credit system.

Inflation Targeting Framework & Policy Stance

- The flexible inflation targeting (FIT) framework mandates MPC to keep inflation close to 4%, within the band of 2–6%.

- The central government, in consultation with RBI, notifies the inflation target periodically (every 5 years).

- MPC’s decisions include not only rate changes, but also the stance of policy — e.g. accommodative, neutral, or hawkish.

- Accommodative stance: encouraging growth, lower interest rates

- Neutral stance: cautious balance

- Hawkish / contractionary stance: tightening to curb inflation

Functions & Significance

- Setting benchmark rates — primarily the repo rate

- Controlling inflation — maintaining price stability

- Signalling to markets — giving clear forward guidance to investors, banks, borrowers

- Ensuring credibility and accountability — decisions are collective, transparent

- Balancing growth and inflation — not overly tight to choke growth, nor loose to allow inflation runaway

- Macro-stability — supporting financial stability and exchange rate behavior

Challenges & Criticisms

- Lag effect — monetary decisions impact with time lags; may not match immediate shock.

- Data dependency — quality and timeliness of data matter a lot; wrong data → wrong decision.

- Coordination with fiscal policy — monetary cannot succeed alone if government pours in large deficits.

- Limited control over supply-side inflation — prices due to supply shocks (e.g. food, fuel) may not be tamed by rate cuts.

- Uneven transmission — rate cuts may not reach rural or small borrowers strongly.

- Bounded mandate — growth vs stability trade-off, sometimes difficult choices.

Exam Pointers (Quick Revision)

- Established: 2016 (via amendment to RBI Act)

- Members: 6 (3 ex officio from RBI, 3 external)

- Tenure of external members: 4 years, non-renewable

- Voting: one vote each; Governor has casting vote in tie

- Meetings: 6 per year (bi-monthly)

- Inflation target: 4% CPI ± 2%

- Key tool: Repo rate (plus others)

- Functions: inflation control, growth support, credibility & transparency

FAQs on Monetary Policy Committee

Why was MPC created?

To bring transparency, accountability, and systematic decision-making in rate-setting and to remove discretionary power from a single person.

Who decides the inflation target for MPC?

The central government, in consultation with the RBI, notifies the inflation target periodically (typically every 5 years).

What happens in case of a tie in MPC voting?

The Governor of RBI gets a casting vote (tie-breaker).

Can external members of MPC be reappointed?

No, external (government-nominated) members generally cannot be reappointed.

Is MPC’s decision binding on RBI?

Yes — decisions made by MPC (e.g. repo rate) are binding on RBI and must be followed.

The Monetary Policy Committee (MPC) is a pivotal institution in India’s macroeconomic governance. It ensures that interest rate decisions are collective, evidence-based, transparent, and accountable — balancing the twin goals of price stability and economic growth.